Payday Cash Loans Manufactured Simple Via Some Suggestions

Online Payday Loans Produced Simple By way of Some Suggestions

Pay day loans have a negative standing. A pay payday loans near me day loan is just not necessarily a poor thing, even so. Situations do exist when payday cash loans can be a practical option for some. Must you know more about the subject? Read on for additional details on this subject.

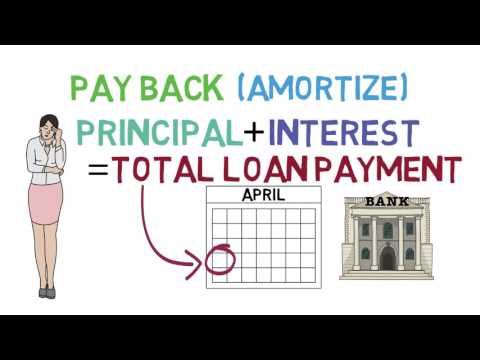

Be sure to comprehend the fees that come with the loan. It is attractive to pay attention to the funds you can expect to get instead of consider the fees. Make certain to acquire whilst keeping replicates of all papers associated with your loan. You'll minimize the quantity you need to reimburse through taking these actions prior to taking out the money.

Research these ahead of time, prior to deciding to decide on a pay day loan company. Don't pick a organization even though they look good in tv commercials. Do your online research and discover should they be likely to scam you or when they are respected. If you choose a dependable firm, your experience should go much more effortlessly.

Pay day loans aren't all alike. Check around to discover a company, as some provide easygoing phrases and minimize rates of interest. It could seriously help cut costs and get away from ripoffs, though doing a little study on distinct lenders will spend some time.

Seek information into precisely what is linked to acquiring a payday advance. There are particular what exactly you need to take with you when looking for a pay day loan. Ensure you have latest shell out stubs, a bank checking account and correct recognition. Specific companies may have their own personal demands. Always phone forward to discover what may be required.

Check out various creditors before deciding how you can find a cash advance. Some loan providers have greater rates, among others may possibly waive certain service fees for picking them. Some may well provide cash immediately, while many could have a waiting period. You can find that loan that is perfect for your specific condition should you analysis distinct firms.

Go along with a company that is a direct loan provider rather than an indirect lender. The Internet is filled with web sites which use your personal information to discover a loan company, that may be risky.

As soon as you get your payday advance it really is a blunder to seem like you will be in the clear. Make sure that you understand the actual times that payments are due so you document it someplace you may be reminded of this typically. Malfunction to spend with the due date could cause simply being billed a lot of cash.

Try to look for a lender that offers financial loan acceptance immediately. Their functioning is very much right behind the days that you just possibly usually do not might like to do business with them when they can not know without delay in this electronic digital world whether they will certainly financial loan you cash.

If you're in payday advance trouble, businesses can be found that can help you. They offer their providers free of charge and may aid discuss a reduced rate of interest or even a debt consolidation to enable you to escape the vicious circle of payday loan monthly payments.

You might like to look at gonna a person for debt guidance if you're generally experiencing to utilize a cash advance support. This can teach you to handle your income greater. Online payday loans can cost a lot of cash if utilized incorrectly.

A lot of these creditors have reviews around the BBB website. Prior to selecting any loan company, you can even examine BBB's web site. If you realise any complaints, you must look for a distinct business for your personal loan.

Check out the Much better Organization Bureau's internet site for specifics of various pay day loan companies. Numerous aren't reliable, however there are several that happen to be honest and very good. It is recommended to locate yet another business to use from in case a loaning company has a lot of complaints from them.

Try using cash payday and developments loans as little as you may. You may need credit counseling that will help you with cash management if you're getting troubles. If you're not mindful, Payday cash loans can force you in the direction of a bankruptcy proceeding. Attempt to stay away from these personal loans just as much as you can, except when the specific situation is dire.

Stay away from entering into an endless debts pattern. So that you can pay off a preceding one particular, in no way get one financial loan. When you have to firm up your belt, you might have to eliminate the origin of the financial debt, even. Anybody can wind up trapped in this type of routine, so be sure you don't. It could amount to quite a lot of money.

Tend not to placed your personal for any contract that you are currently not completely aware about the better information of initial. Big admin costs as well as other concealed charges could be in the small print. You must learn all these kinds of costs before signing the contract otherwise you may well be subjected to distressing surprises in the future.

Take into consideration what you're intending to do before applying for any payday loan. Do it becomes clear that a pay day loan has a common APR in between 378 - 780 percentage? Consequently, it costs about 1/4 of the cash that you just obtain in attention. You may choose it's worth it if it's your only access to dollars.

Now that you have extra information on payday loans, you will be able to are excellent selections with regards to them. Ensure that you utilize the data which you gained right now, to be able to have a relaxed upcoming. You will also have a lot less stress to cope with. Instead, use these lending options moderately and simply right after the recommended investigation. Then work to stay in your means to be able to create a more seem economic ground.

Particular Recommendations On Payday Cash Loans And Whenever To Utilize Them

Particular Recommendations On Online Payday Loans And Whenever To Utilize Them

Many reasons exist men and women take out payday loans. It is crucial for almost any person to research all the things associated with pay day loan prior to utilizing it. And once you buy your loan, by reading this post you will have a wise decision of what you must dojust before and through.

Be sure about when you are able reimburse financing prior to take the time to use. These personal loans have very high interest rates. You may experience a lot more costs if you can't pay back these lending options quick.

Your salary you are expecting might be removed after it can be given to the pay day loan firm. This will cause you difficulties over the following spend time which could give you operating back for another cash advance. You could be compelled to continually get personal loans which may previous for a while if you're struggling to shape this out.

Prior to getting prepared to employ a cash advance service, it is a great idea to contact the more effective Organization Bureau and look the organization out. When you accomplish that, you will find out useful info, for example track record and problems from the payday loans near me loan provider.

By no means lie on the payday loan app. When you embellish the reality, however, you may end up having prison time as an alternative, it may seem you'll get a far better personal loan.

Ensure that you seek information before selecting a financial institution. Only steal your banking info, though there are a lot of con designer loan providers which will assure you a loan. You will get an even better feeling of the company's techniques by reading through reviews from shoppers that have carried out enterprise using them.

Consider other options. Some organizations will provide you with more effective phrases than one more company will. This is an excellent strategy to avoid shelling out a lot more than required. All of it is dependent upon your credit score and the money you want to obtain. You will end up certain to get the best feasible package, by finding the time to investigate distinct bank loan possibilities.

Will not indication a payday advance that you simply do not recognize as outlined by your agreement. They are likely working high charges unidentified towards the user in case a company select never to disclose a bunch of their info within a respectable manner.

They can also overdraft your bank account, although pay day loans may possibly cost huge charges and high interest rates. Bounced inspections can be extremely high-priced when included in the top expense of payday cash loans by themselves.

Before you sign it, browse the cash advance agreement phrase for word. Payday cash loans tend to be riddled with concealed costs and charges. Read all of the small print to ferret these out. You're set for a poor big surprise once your payback time is delivered, you must be aware of individuals types of costs if not.

You will likely need to have some telephone numbers when you get a payday loan. Your payday advance organization rep will want one to allow them to have all of your telephone numbers, additionally quantities of your career. On the top of these kinds of information, plenty of loan companies would also like private personal references.

Make sure to comprehend the regulations of your respective state when it comes to online payday loans. Laws about lending hats vary from state to state. It isn't rare to locate unlawful lenders that function in states they are not able to. Once you have this information, investigate the laws governing financing procedures.

When you crash to pay back your cash advance promptly, the cash that you just are obligated to pay enters into series. This may substantially damage your credit ranking, adding you inside a inadequate situation. It is vital that your banking accounts has sufficient funds on the day you know the business will be getting their cash.

Pay attention to exactly how much monthly interest the cash advance you're getting has. There are several that keep this data hidden and difficult to find, though some businesses will come straight out and inform you what price you are going to shell out. Constantly bear this in mind when you are considering receiving a pay day loan.

The most effective organizations will probably be in advance regarding attention and service fees. In no way consent to that loan coming from a firm who doesn't clarify costs evidently, or attempts to confuse consumers by organizing in additional service fees which can be buried serious within a agreement. If you simply will not have enough funds to handle payment on its because of particular date, prepare an extension in advance, be careful about your bank account cautiously.

Imagine getting a payday loan for an option of final option be sure to exhaust other possible money options very first. There can be options in your household or good friends. Otherwise, perhaps your bank that can preclude going to a cash advance firm. As they are so pricey, it's wise to keep away from pay day loans, whenever possible.

Be sure you completely comprehend the rate of interest along with other fees that you may be charged for this sort of bank loan, prior to accept an offer for a payday advance. Time spent producing the loan's expense prior to taking it would guard you against becoming unpleasantly amazed at fees you didn't assume when you're attempting to pay it off.

Many individuals used pay day loans like a method to obtain simple-phrase funds to cope with unpredicted expenses. Ensure that you fully fully grasp all there is with it, well before employing this sort of financial loan. Use only payday loans at times and for short-term urgent matters.

Essential Things You Should Know About Pay Day Loans

Significant Things You Should Know About Payday Cash Loans

Just before we have now the resources to pay them, it is often the way it is that expenses are expected. A payday loan might help in this situation, nevertheless they shouldn't be used out softly. This post will help you figure out no matter if it is an suitable remedy for your short-expression needs.

Make everything you may to repay the borrowed funds by the time it really is due. You will basically ingredient the attention and then make it even more difficult to pay off the financing down the line when you increase these personal loans.

Steer clear of simply driving towards the closest financial institution for any pay day loan. For you to do your research before heading there, although you may know these are surrounding you. If you need to remove a pay day loan, a tiny bit of investigation can compensate you with savings of several hundred dollars.

Shop around for the very best rate of interest. There are standard cash advance enterprises situated across the area and some online too. On-line lenders tend to offer competing costs to draw in anyone to work with them. Several payday loan providers will decrease the costs for anyone credit the first time. Check around for every one of the alternatives well before going with a financial institution.

Contact the lending company and ask them to transfer your payment date back if your loan's pay back day shows up and you don't have sufficient resources to pay your loan provider back again. Usually, there are actually these companies can provide you with an extra few days. Simply be aware that you may have to spend a lot more should you get one of these simple extensions.

Beware of any company that wants to roll financing fees to another shell out period of time. This brings about individuals paying out every one of the charges with out ever paying back the borrowed funds. Just before things are mentioned and carried out, it is not necessarily unheard of to pay a lot more than quadruple the price of the financing.

Before deciding on a paycheck loan company, research prices. Each spot could have distinct tourist attractions and plans to appeal you through the doorway. 1 place might be able to account the borrowed funds within an hr, or else you may wait around for days at one more. Shop around and examine interest rates for the greatest solution offered.

When you obtain a financial loan with a paycheck online site, you should make sure you might be coping directly using the payday advance creditors. A lot of internet sites really exist that take economic details to be able to set you having an correct loan provider, but such sites hold important threats too.

There are actually agencies that will help you in making agreements to settle your overdue payday cash loans. Once and for all consider a selection of their totally free providers to help you get decrease interest rates so that you can begin to spend your loans back again.

Discover the pay day loan charges prior to receiving the funds. The lending company may possibly demand $30 for a loan lasting just a couple several weeks, for example, in case you are getting $200. This figures to with regards to a 400% monthly interest per annum. If settlement is difficult inside of one pay out period, the borrowed funds costs boost further.

Make it a point that you are currently utilizing the proof of job and proof of age together with you when putting your signature on to get a pay day loan. To fill in a pay day loan app, you must present confirmation that you are currently a minimum of 18 as well as your revenue is constant.

Research your options about any loan company before signing nearly anything. Usually know what you're engaging in before you sign anything. Be sure the clients are honest and utilize historic details to estimate the exact amount you'll pay out as time passes.

Provided you can stay away from handling a long-length loan provider who needs you to fax your details, do so. Like the majority of individuals, you most likely shortage a fax equipment, even though some lenders expect you to fax spend stubs or some other papers. If you choose the correct loan company, community version stores could charge as much as $5 a webpage to fax with your documents, which cost is easily averted.

Just before a cash advance, go online. Search for a reputable organization by investigating or through getting a reference point from a trustworthy buddy. Then fill out their on the web kind and view to have an endorsement inside of round the clock.

When applying for a payday advance, you may be required to cook a be sure that addresses the financing along with the interests. You ought to be sure that your funds are in your bank at the time the check is post outdated for. Your financial institution will charge an overdraft account charge as well as charges incurred through the pay day loan company in the event the check out is came back.

Before getting a payday loan, reveal regardless of whether this really is a real financial crisis . Payday cash loans must basically be utilized for dire emergency situations. It is actually in no way smart to use this kind of loans merely as a approach to steer clear of consuming your financial situation securely in hand.

Select a paycheck loan company that is well known. Should you be unable to make the payments in a well-timed fashion, Shadier financial loan providers usually use debt collectors who may possibly attempt to scare or perhaps threaten you. Should you not pay back the borrowed funds on time, Pay day loan businesses with good track record will simply charge a greater charge.

It really is a quite bad thought to take out a pay day loan every spend time, but applied sensibly, a cash advance could be a payday loans godsend. Pay day loans should only be part of a last option and should be just be applied smartly. Take this into account when you want money once more.

Helpful Advice On Handling Your Following Pay Day Loan

Helpful Advice On Handling Your Upcoming Cash Advance

Most people have read about online payday loans but may not know the legal aspects and just how they job. You will be probable interested in be it easy to have a bank loan that way, and regardless of whether you would be somebody that is qualified. This short article will enable you to recognize how pay day improvements job, and permit you to make knowledgeable options about these services. Follow these tips to find out if a payday loan can assist you.

Should you be thinking about creating a pay day loan software, you need to have a clear thought of the particular date with that you can repay the borrowed funds. If repayment is slow-moving, extra fees and expenses can build-up, interest charges on these kinds of personal loans are often quite high, and.

Pay day lender use numerous techniques to obtain close to consumer defense legal guidelines. They'll demand costs that add up to the loan's attention. A loan can collect as much as ten times the interest of your regular financial loan, because of this.

You usually need to have to be aware of the rates of interest. That's an excellent issue to not forget when trying to get online payday loans. By no means sign anything at all till you completely grasp the terminology. You might have found a scam if a clients are not genuine about charges and charges.

A great deal of payday loan creditors pressure people to indicator deals which will protect them through the quarrels. Lenders' financial obligations usually are payday loans not released when consumers submit a bankruptcy proceeding. In addition, the borrower have to signal a document agreeing to never sue the lender when there is a question.

If you wish to take out a cash advance, get the most compact amount it is possible to. Occasions are difficult and there are a variety of reasons why an individual would need some more income. That rates of interest really are high on payday loans, even though bear in mind. Be sure to keep your costs as low as achievable by lessening your loan volume.

Ensure that you know the expected particular date in which you have to payback your loan. Rates of interest for payday cash loans are typically quite high. Past due fees are even higher. The money quantity and all related costs needs to be readily available for the cash advance business to take out through your checking account on your own agreed expected particular date.

Cheaper choices, do not apply for a pay day loan just before considering other. The costs for a charge card money advance continue to be a lot less than those with a pay day loan. Even better, look for a family member or friend prepared to help you out.

Payday loans not just carry hefty service fees, unless you possess the money to repay them, they can also lead to an overdraft payment from the financial institution. In the event the dollars for any transaction isn't with your profile, then you can put overdraft costs to the present cost of a cash advance.

Ensure the loan company you decide on is accredited within the express you are getting the financing. Laws and regulations be different between states. The goal is to buy a legit and authorized bank loan. Your loan company needs to be registered to operate in your state.

Should you suddenly are offered additional money than you will need, the sensible option is to make them lower. The greater number of you borrow, the greater you will have to shell out in curiosity and charges. Only acquire just as much as you require.

Be truthful when using for a financial loan. Don't feel this will likely assist you in receiving the financial loan, the fact is businesses that provide payday cash loans are used to coping with candidates who have a low credit score and shaky work steadiness. Being untruthful will just increase the probability of you being unable to get a pay day loan now and in the foreseeable future.

Do on your own the love of buying each of the opponents if you are intending to take out a cash advance. You can find go walking-in and on-line pay day loan companies. Do a comparison to determine which will give you the most beneficial offer. If you this, you may find on your own in a far better economic place.

Discovering exactly where your loan company is situated will tell you a lot about the sort of services you can anticipate. Status regulations fluctuate, so you should know which condition your loan provider resides in. Quite often, unethical paycheck organizations function international in locations that don't have lending regulations which are tough. When you discover what express they can be located in, find out the laws there.

If you do not pay your pay day loan back again by the due date, the total amount you go goes into series, be aware that. That can harm your credit score. Ensure you have sufficient cash within your bank account to cover your payday loan personal debt.

Your credit ranking a lot of not come into concern in terms of online payday loans. Payday loan providers want to validate your task and income and make certain they may accessibility money from your paycheck. Most on the web loan companies don't even do credit report checks.

Should you acquire cash using a payday loan, consider exactly how much it is going to price. They are not that substantial that they will hurt you poorly, even though you can find great costs associated with these personal loans. Pay day loans have been in a small amount, normally which range from $100 to $1,500. With relevant fees, integrated interest and explained charges, you could potentially turn out spending approximately $30 for each $100 obtained, for a loan time of 2 weeks. Make sure repayment is an element of the spending budget on the next pay out time.

So now you are furnished with the important points needed to make intelligent alternatives when it comes to online payday loans. You are now designed with the data you need to far better fully grasp online payday loans. You may have obtained some valid and sincere information and facts, now you can decide if you should continue further.

Best Ways To Go About Receiving A Payday Advance

Great Ways To Approach Receiving A Payday Advance

If you're stressed above funds and you require a fast solution, there may be a method to chill out. A quick remedy for a short-run problems can be a payday advance. Despite the fact that, using this type of financial loan will come a great deal of risk that you must know about. These tips could be valuable.

Be sure that you comprehend all charges you have to pay out. They will likely begin piling up, although it could be simple to just have the figure and money that you can worry about costs at a later time. Check with the organization for published evidence of all service fees you may be liable for. Achieving this before you take the bank loan can save you from getting to get rid of over you actually obtained.

Avoid jumping in the vehicle and driving to the first place that gives online payday loans. Should you some research on other businesses inside your area, you could find one which delivers far better terms, even though you definitely know your community. You can definitely save a ton of money by evaluating charges of numerous lenders.

If you can find any invisible service fees, make sure you ask. You won't know if you do not take the time to inquire. You ought to be crystal clear about all of that is concerned. It really is frequent for people to get a higher bill compared to what they awaited after they indication on the dotted range. You may prevent this by looking at this assistance and asking questions.

Payday loans are sometimes valuable for people with no other loans options. Prior to getting associated with a cash advance, they ought to find out about them. Fascination expenses tend to be quite high and accompanying charges might make this kind of financial loans challenging to repay.

You may not be out of luck when you are close to a status collection and loans will not be offered locally. Find a suggest that permits pay day loans and create a visit to get the loan. This at times means one getaway since they electronically restore their resources.

Make sure of the fees you will certainly be incurred whilst paying back the financing. This could trigger payments to frequently spend toward the service fees, which can spell difficulty to get a customer. Prior to they can get rid of it, some customers have paid considerably more than the quantity of the original personal loan.

When taking out a pay out day time personal loan, try to look for a financial institution that provides straight deposit. This will give you the cash instantly, straight away. In addition to being very convenient, in addition, it permits you to prevent the need to stroll all around with all the dollars you borrowed.

It is important to know which files will be asked to obtain your payday advance. This can include shell out stubs and ID. Before heading to discover what you must provide with you, you should phone the firm up.

Consider other bank loan alternatives together with pay day loans. Even though credit cards cost reasonably high interest rates on cash developments, for instance, they are nevertheless not nearly as much as all those associated with pay day loan. You need to try out credit dollars from friends and family.

Individuals aiming to obtain payday cash loans should understand that this would only be done when all other alternatives are already worn out. These personal loans have massive rates of interest and you will effortlessly end up having to pay at least 25 % of your own initial personal loan. Generally be aware of options available before applying for online payday loans.

Do not get caught in a vicious circle of financial debt. Ensure you are not taking out a cash advance to be able to pay yet another one off of. It is important to split without any the routine, even when accomplishing this requires sacrifices. It is possible to discover youself to be getting more and more into debt if you do not position payday loans online the braking system on your investing. It can cost a great deal of money.

When attemping to organize from the article-urgent price range, your main priority needs to be staying away from another crisis and obtaining issues moving again. Don't be lulled into feelings of complacency because the payday advance has protected your skin layer for that time. You still have to pay back the cash.

Make sure the payday loan organization has your entire contact details. You will generally need to reveal your property contact number, mobile amount as well as your employer's number. In addition to these numbers, you may even need to provide the amount of three other references.

Before applying to get a pay day loan, make certain you understand that organization that you are currently planning on making use of. Thankfully, harmless loan companies tend to be those using the finest stipulations, to get both in a single after some study.

You can ask for assistance from family members for fast cash as opposed to the financial loan. Your relatives and buddies could struggle to provide every one of the allow you to will need, but each and every bit will minimize the sum you will need to remove in payday loans. If the quantity you borrow is less, this can save you a ton of money in interest costs.

Simple and easy handy online payday loans which do not need you to fax a comprehensive level of paperwork are sometimes available, but at a cost. The costs and fascination will probably be steeply better. You will certainly be paying greater fascination, affiliate and charges fees than if you went using a diverse enterprise.

They are utilized successfully, provided that you learn about online payday loans. Utilize the recommendation with this post so you find yourself making smart alternatives when it comes to dealing with your fiscal difficulties.